US Taxes

What is Us Tax?

U.S. Tax refers to the system of taxes imposed by federal, state, and local governments in the United States on income, goods, property, and services. Here’s a simple breakdown:

🔹 Main Types of U.S. Taxes

- Income Tax

- Federal income tax: Collected by the IRS from individuals and businesses.

- State income tax: Some states (like California or New York) also collect their own income tax.

- Based on how much money you earn.

- Paid by both individuals and corporations.

- Payroll Tax

- Taken from employee paychecks to fund Social Security and Medicare.

- Shared by both employers and employees.

- Sales Tax

- Added when you buy goods or services (like at a store or restaurant).

- Collected by state and local governments (not federal).

- Rate varies by state (e.g., 0% in Delaware, ~7-10% in California).

- Property Tax

- Paid by owners of land and buildings.

- Used to fund local services like schools, police, fire departments.

- Corporate Tax

- Businesses pay tax on their profits.

- Federal corporate tax rate is 21%, plus possible state taxes.

- Capital Gains Tax

- Tax on profit when you sell an asset, like stocks, real estate, or investments.

- Estate & Gift Tax

- Paid when transferring wealth, such as inheritance or large gifts.

🔹 Who Collects the Taxes?

- Federal government: Through the IRS (Internal Revenue Service).

- State governments: Each state has its own tax department.

- Local governments: May charge property taxes, local sales tax, etc.

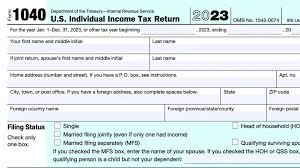

🔹 Filing Taxes

- U.S. citizens and residents must file a tax return each year (usually by April 15).

- You report your income, calculate tax owed, and either pay or get a refund.

Who should register for US TAXES RETURN?

- In the United States, filing a tax return is required for certain individuals and entities, depending on income, filing status, age, and type of income. Here’s a breakdown of who should register (file) for a U.S. tax return:

- ✅ Individuals Who Should File a Tax Return

- 1. U.S. Citizens and Resident Aliens

- You must file if:

- Your income exceeds the minimum filing threshold.

- You had self-employment income of $400 or more.

- You received Advance Premium Tax Credit (subsidy) for health insurance.

- You owe special taxes (e.g., early withdrawal penalties, alternative minimum tax).

- 2024 Income Thresholds (for 2025 filing):

- 2. Nonresident Aliens (NRA)

- You must file Form 1040-NR if:

- You earned U.S.-source income (like wages, rent, interest).

- You are engaged in a U.S. trade or business.

- You want to claim a refund of overpaid U.S. tax.

- 3. Self-Employed Individuals / Freelancers

- Must file if net earnings are $400 or more (even if under income threshold).

- Must pay self-employment tax (Social Security + Medicare).

- 4. Dependents (e.g., Students)

- Even if someone else claims you as a dependent, you may still need to file if:

- You earned more than $1,250 (unearned) or $13,850 (earned) in 2024.

- You had self-employment income over $400.

- 💡 Other Reasons to File Even If Not Required

- You may want to file a return if:

- You qualify for a refund (e.g., too much tax withheld).

- You want to claim credits like:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- American Opportunity Credit (education)

- Stimulus Recovery Rebate

- 🧾 Entities That Must File

- Corporations (Form 1120)

- Partnerships (Form 1065)

- LLCs (varies by election)

- Trusts and Estates (Form 1041)

Process of US TAX

✅ Step-by-Step: How to Register a Business in the U.S.

1. Choose Your Business Structure

Select the legal form of your business:

- Sole Proprietorship – Simple, for solo owners

- Partnership – For 2 or more owners

- LLC (Limited Liability Company) – Popular for small businesses (personal asset protection + flexibility)

- Corporation (C-Corp or S-Corp) – For larger companies or raising capital

2. Pick a Business Name

- Check availability via your state’s business name database

- Check domain name availability if you want a website

- Avoid trademark conflicts (optional: check USPTO database)

3. Register Your Business with the State

- LLC or Corporation: File formation documents like:

- Articles of Organization (for LLC)

- Articles of Incorporation (for Corporation)

- File with the Secretary of State in your chosen state

- Pay state filing fees (typically $50–$500 depending on the state)

4. Get an EIN (Employer Identification Number)

- Apply for free via the IRS: https://www.irs.gov/ein

- Required if you have employees, or for opening a business bank account

5. Register for State and Local Taxes

- Sales Tax: Register with state revenue department if selling goods

- Income Tax: Some states require separate registration

- Employment Taxes: If hiring employees, register for state unemployment and withholding taxes

6. Get Required Business Licenses and Permits

Depends on your:

- Industry (e.g., food, construction, retail)

- City or county regulations

Check local city/county websites or use https://www.sba.gov

7. Open a Business Bank Account

Use your EIN and registration docs to open a dedicated business bank account (separates personal and business finances).

📝 Optional But Recommended:

- Create an Operating Agreement (LLC) or Bylaws (Corporation)

- Set up accounting software or system

- Consider insurance (general liability, worker’s comp, etc.)