US tax return

What is a Tax Return in the U.S.?

Before we jump into the topic of tax returns, we should understand what taxes are in the United States. In the U.S., taxes are financial charges imposed by federal, state, and local governments on individuals and businesses to fund public services and infrastructure.

If we earn income through a job, business, investments, or any other source, we are required to file a tax return. A tax return is a formal statement filed with the Internal Revenue Service (IRS) and/or state tax departments that reports income, expenses, and other relevant tax information.

Earlier, the U.S. tax system included multiple forms of taxes at various levels (federal income tax, state income tax, social security tax, Medicare tax, sales tax, etc.). Taxpayers often found the system complex, but over time, the IRS has simplified and digitized the process of filing returns, making it easier to comply.

The IRS (Internal Revenue Service) is the federal agency responsible for tax collection and tax law enforcement in the United States. Taxpayers generally file returns annually, and based on their income, deductions, and credits, they may either owe additional tax or receive a refund.

Let’s Talk About U.S. Tax Returns

Normally, in a U.S. tax return, there is a summary of your financial activities during the year. This includes your income, business sales (if applicable), investment gains, interest earned, and certain payments like mortgage interest or charitable donations. It does not typically include credit card payments or unrelated transactions, but it does account for income tax payments already made—like withholding from your paycheck or estimated tax payments.

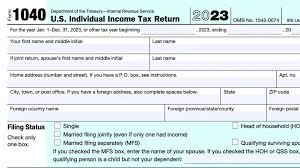

When you file your federal tax return, forms like Form 1040 are used to report your income and claim deductions or credits. Some data, such as income from employers (W-2) or other institutions (1099 forms), may be prefilled or electronically fetched if you’re using tax software.

If you’ve paid more in taxes than you owe, the IRS will issue a refund. This is common for employees who have taxes withheld from their pay throughout the year.

What Does a Tax Return Contain?

The U.S. tax return includes information about:

- Your total income from wages, self-employment, investments, etc.

- Deductions (like student loan interest, retirement contributions, etc.)

- Tax credits (such as Child Tax Credit or Earned Income Tax Credit)

- The amount of tax you owe or the refund you’re eligible for

Whether you’re running a business or working as a freelancer or salaried employee, you must submit a tax return to the Internal Revenue Service (IRS) if your income exceeds the minimum filing threshold.

Filing a U.S. Tax Return Online

You can file your tax return online using official IRS tools (like IRS Free File) or through tax software providers (e.g., TurboTax, H&R Block). If you have a computer or a laptop, filing online is straightforward. Even if you don’t have a PC, you can use your smartphone to file your return through mobile apps. It’s convenient, but you must be careful and accurate while entering your details.

Types of U.S. Tax Returns

In the U.S., tax returns are formal documents filed with the Internal Revenue Service (IRS) to report income, calculate taxes owed, and claim refunds or credits. There are different types of returns and forms depending on the nature of income, business, or entity. Here’s a summary of the main types:

- Form 1040 (Individual Income Tax Return):

This is the main return filed by individuals. It includes total income, deductions, tax credits, and the final tax liability or refund. - Form 1040 Schedules (A, B, C, D, etc.):

Used to provide additional details:- Schedule A: Itemized deductions

- Schedule B: Interest and dividends

- Schedule C: Business income

- Schedule D: Capital gains and losses

- Form 941 (Employer’s Quarterly Tax Return):

Filed by employers to report wages paid, income tax withheld, Social Security and Medicare taxes. - Form 1120 (Corporate Tax Return):

Filed by C Corporations to report business income, expenses, and calculate corporate tax. - Form 1065 (Partnership Tax Return):

Filed by partnerships to report income, deductions, and share of profits/losses to partners. - Form 990 (Nonprofit Organization Return):

Filed by tax-exempt organizations to maintain transparency and report activities and finances. - Form 1099 Series (Information Returns):

Issued to report various types of income other than wages—like freelance income, interest, dividends, etc. - Form W-2 (Wage Statement):

Filed by employers and provided to employees to show earnings and taxes withheld during the year. - Form 4868 (Extension Request):

Used to apply for an extension to file an income tax return (but not to delay payment). - Refund or Adjustment Forms (e.g., Form 843, 8849):

Filed to claim refunds or request corrections in case of overpayment of taxes.

U.S. Tax Return Filing for Foreign Taxpayers

- 📝 Form 1120-F (U.S. Income Tax Return of a Foreign Corporation):

- If a foreign company or non-resident is doing business in the United States, they must file Form 1120-F. This return contains complete information about the business activity in the U.S., such as:

- Income earned from U.S. sources

- Deductions and expenses

- Taxes owed on that income

- This form helps the IRS determine the U.S. tax liability of foreign corporations. It must generally be filed by the 15th day of the 4th month after the end of the corporation’s tax year (usually April 15).

- 📥 Form 1042 and 1042-S (For Withholding on Payments to Foreign Persons):

- If you are a U.S. company or business paying foreign individuals or entities, you are required to withhold taxes and report those payments using:

- Form 1042 – Annual return for tax withheld on U.S. source income of foreign persons

- Form 1042-S – Statement for each foreign person receiving U.S. income

- These forms must be submitted annually, with Form 1042-S due by March 15, and Form 1042 due shortly after.

- 🔁 Form 5472 (Foreign-Owned U.S. Corporations):

- If a U.S. company is 25% or more foreign-owned, or a foreign company is doing business through a U.S. branch, Form 5472 must be filed along with Form 1120 or 1120-F.

- This form includes detailed reporting on:

- Business transactions between U.S. and foreign entities

- Imports, exports, services, and other inter-company dealings

- Failure to file may result in hefty IRS penalties.

- 🔄 Electronic Filing and Timelines:

- Just like GSTR returns in India, many of these U.S. forms can also be filed online using certified IRS e-file providers. Proper record-keeping and timely submission are essential to avoid penalties and ensure compliance.

U.S. Tax Return for Withholding Agents

🧾 Form 945 (Annual Return of Withheld Federal Income Tax):

If you are a withholding agent in the U.S.—meaning you deduct and withhold federal income tax on payments other than wages (such as pensions, IRAs, gambling winnings, etc.)—you must file Form 945.

This return includes:

- Details of the total federal income tax you withheld during the year

- The exact amount deposited with the IRS

- Adjustments, if any, due to over- or under-withholding

🔔 Due Date: Usually January 31st of the following year.

Late filing or payment may result in IRS penalties and interest.

📄 Form 945-A (Record of Federal Tax Liability):

After filing Form 945, a detailed schedule called Form 945-A may be required for semiweekly depositors. This is similar to how GSTR-7A auto-generates once GSTR-7 is filed.

Form 945-A:

- Is automatically linked to your tax account once Form 945 is submitted

- Shows date-wise summary of the taxes deposited and withheld

- Can be downloaded and used as a reference for IRS communications

🔄 Summary:

- Form 945 = Like GSTR-7 → Annual return for tax deducted at source (other than salary)

- Form 945-A = Like GSTR-7A → Auto-generated statement with tax deduction and payment details

These forms are important for ensuring accurate tax reporting and credit reconciliation between the taxpayer and the IRS.

U.S. Tax Return for E-Commerce Platforms

- 🧾 Form 1099-K (Payment Card and Third-Party Network Transactions):

- If you run an e-commerce platform like Amazon, Etsy, or eBay, and you process payments for sellers, you are required to report those transactions to the IRS using Form 1099-K.

- This form includes:

- Total gross sales processed through your platform

- Number of transactions

- Amount paid to each seller

- You must issue Form 1099-K to each seller and submit it to the IRS. This helps the government track seller income and tax obligations.

- 🛒 Marketplace Facilitator Laws (State-Level Sales Tax Collection):

- In addition to IRS reporting, U.S. e-commerce platforms must also collect and remit state sales tax on behalf of sellers. This is similar to how the government deducts and tracks taxes under GSTR-8 in India.

- Platforms are required to:

- Collect sales tax from customers on behalf of sellers

- Remit that tax to the respective state governments

- File state-level sales tax returns regularly (monthly, quarterly, or annually)

- Maintain a record of all sales, tax collected, and returns filed

- 🗓 Deadline: Filing deadlines vary by state, but most states require payment by the 20th of the following month (similar to GSTR-8 being due by the 10th).

🧾 Form 1099-K (Payment Card and Third-Party Network Transactions):

If you run an e-commerce platform like Amazon, Etsy, or eBay, and you process payments for sellers, you are required to report those transactions to the IRS using Form 1099-K.

This form includes:

- Total gross sales processed through your platform

- Number of transactions

- Amount paid to each seller

You must issue Form 1099-K to each seller and submit it to the IRS. This helps the government track seller income and tax obligations.

🛒 Marketplace Facilitator Laws (State-Level Sales Tax Collection):

In addition to IRS reporting, U.S. e-commerce platforms must also collect and remit state sales tax on behalf of sellers. This is similar to how the government deducts and tracks taxes under GSTR-8 in India.

Platforms are required to:

- Collect sales tax from customers on behalf of sellers

- Remit that tax to the respective state governments

- File state-level sales tax returns regularly (monthly, quarterly, or annually)

- Maintain a record of all sales, tax collected, and returns filed

🗓 Deadline: Filing deadlines vary by state, but most states require payment by the 20th of the following month (similar to GSTR-8 being due by the 10th).